Introducing Stock Item Level Tax

In our newest update, version 2.5.0, we are addressing a highly sought after request for many retail merchants: Stock Item Level Tax.

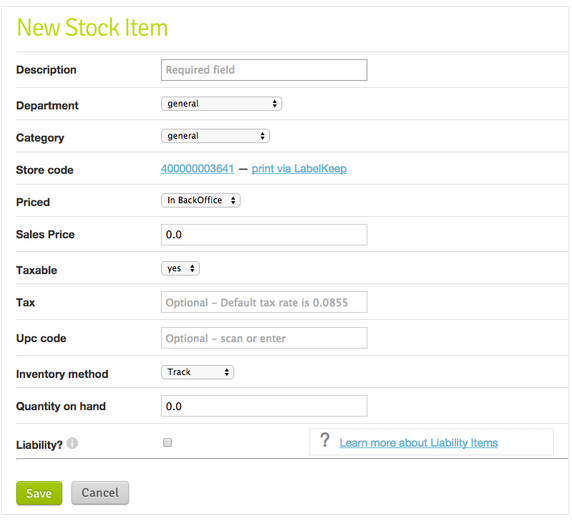

This feature allows merchants to determine the sales tax rate at the item level, rather than just the previous ‘global’ tax rate that would automatically apply to all taxable items. What this means is, if you enter a different sales tax rate for an item, it will use it at the point sale, overriding the global sales tax rate entered in the register settings.

The previous version allowed for only one global sales tax rate. This update benefits merchants who need to set different sales tax rates for different items, and ensures more accurate sales tax collection and reporting.

In the screenshot below, you can see the new section labeled “tax” with an open field to enter the sales tax rate for that specific item, if different from the global tax rate.

This update is a precursor to a more fully-fledged Multi-Tax solution we’ll be working on as we continue to improve the ShopKeep system. We love to hear your feedback, so feel free to let us know what you think of this new release in the comments section below or email us at [email protected].

Want to try ShopKeep for yourself?

Just answer a few easy questions.

Need help finding the right point of sale?

Just complete the form. We’ll call you right back to explain how ShopKeep can work for you.

Hit the ground running.Sprinting, in fact!

Read our free, comprehensive guide, Small Business 101, to learn all you need to know about starting a thriving business.