PayThink: Vendors need to step up small business EMV game

eOriginally published by Michael DeSimone on Payment Source on May 1, 2017.

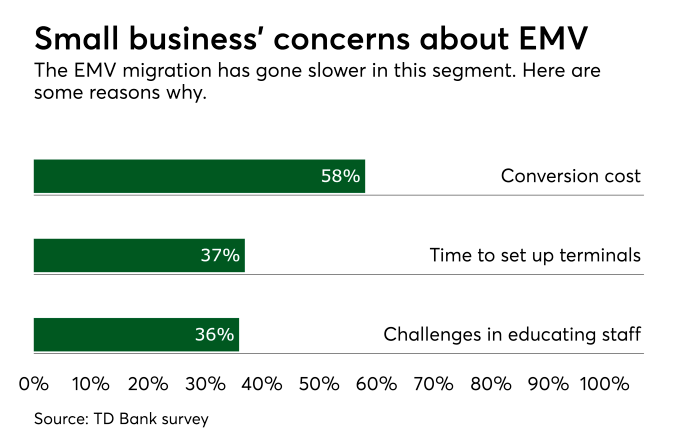

The road to EMV has been a complicated one for small businesses.

Over the course of the transition in the U.S., SMBs in particular have experienced everything from confusion and concern to frustration and annoyance.

This may be why a Wells Fargo survey found nearly half of small businesses reporting that their systems were not EMV chip-enabled, despite the deadline having passed many months prior. Even today, many SMBs have yet to become EMV compliant, and for the point of sale (POS) solutions providers serving them, now is the time to lend a helping hand.

For the independently owned and operated shops and restaurants that make up the country’s small businesses, the person running the operation is often the same person opening the doors every morning and locking up at night. The wide ranging responsibilities of small business owners means they are beyond ‘time-poor’ and are usually “time-negative,” essentially meaning they rarely find enough hours in the day to accomplish everything. For this group, time and resources have never come cheap, which has made their part in the grand EMV migration all the more challenging.

The major retailers and chains were able to anticipate and prepare for the transition to EMV, allocating the necessary resources to make the switch as smoothly as possible, investing in new technology, training their staff and more. But when news of the mandate reached SMB owners, many didn’t have a clear understanding of what EMV was or why they would need it, let alone the ability to invest in the necessary technology or education.

They subsequently found themselves being upgraded to new terminals by the companies that provided their payments infrastructure, but without the needed processing capabilities, leaving them with new devices that simply sat around for a long time. By the time the liability shift had occurred, the frustration was sudden and palpable across the nation. Consumers and businesses alike struggled with the fundamental change to how they used their cards for payment, while SMBs saw EMV as something that would slow down transactions and make their business suffer in the process.

For a small business, the point of sale is everything, the source of truth for its transactions and the cash flow that its well-being lives and dies by. It’s unsurprising that for SMBs there was some aversion to changes that would complicate such a critical function for them. And in their defense, whether or not to become EMV compliant is a matter of balancing the risk of fraud against the compromise of transaction speed. A furniture store with transactions that are low volume but high value certainly must prioritize EMV, but a bakery might prefer to see more customers get in and out quickly and accept the risk of being defrauded for a muffin.

In the near-term, it may seem reasonable for some SMBs to put off EMV. Looking long-term, however, is a different story. Regardless of a business’ capacity for risk, EMV is on track to more or less become the law of the land when it comes to payments standards. Following in the steps of the countries who switched to EMV before the U.S., the use of magstripes will be gradually phased out. Furthermore, companies like Visa and MasterCard have introduced solutions that make chip transactions faster. Additionally, consumers are already getting the hang of using their chip cards, meaning the delays caused by confusion at the point of sale will not last – and inserting a card into a terminal will soon become a habit and an expectation.

Overall, it’s in the best interest of SMBs to make the switch to EMV, as they are otherwise delaying the inevitable. And as the ones who understand the pain points for these businesses best, POS technology providers can serve as allies aiding in the transition.

The most important thing to a small business owner at the end of the day is being able to get paid. A big part of the role of their POS solution provider is to make that as simple for them as possible. With the latest and greatest POS platforms evolving to increasingly serve as end-to-end business management solutions for SMBs, it shouldn’t be outside of their scope to equip customers with EMV processing capabilities as well.

For most merchants, if they spend more than a few dollars investing in POS technology, the thing they should notice most about their payment processing is nothing. Just a simple, straightforward trouble-free transaction. The move towards EMV may have injected complications into the process, but it remains a necessary shift and one that is here to stay. As owners and operators of small, independent businesses prepare to comply, their POS technology providers should lean further into their role as partners and advisors, laying the groundwork to smoothen their transition to EMV and helping them maintain a strong operation without missing a beat.

Want to try ShopKeep for yourself?

Just answer a few easy questions.

Need help finding the right point of sale?

Just complete the form. We’ll call you right back to explain how ShopKeep can work for you.

Hit the ground running.Sprinting, in fact!

Read our free, comprehensive guide, Small Business 101, to learn all you need to know about starting a thriving business.