Clearing Up Misconceptions: Software Advice Talks EMV

After October 2015, all businesses that have not upgraded their payment processing equipment to be EMV chip card compliant may be responsible for paying 100% of any fraudulent credit card transactions – a liability that could put a small merchant’s livelihood at risk.

In our most recent Small Business Index, we asked ShopKeep customers if they felt prepared for the US EMV liability shift, the answer was an overwhelming yes. Of the 1,260 ShopKeep merchants surveyed, 62% said they plan on being prepared to take EMV payments, with technology that helps future-proof their business and practice safer credit card practices. However, this sentiment does not seem to be resonating with the rest of the small business community. In a recent chat with with Justin Guinn, retail market researcher at third-party POS system review site Software Advice, it was clear that small and midsize businesses still feel significantly unprepared for the EMV shift that’s about to sweep the nation. Here’s what we learned:

Your new EMV data point to the fact that adoption amongst the general small business community has been far and few between, especially when it comes to small retailers. What did you uncover?

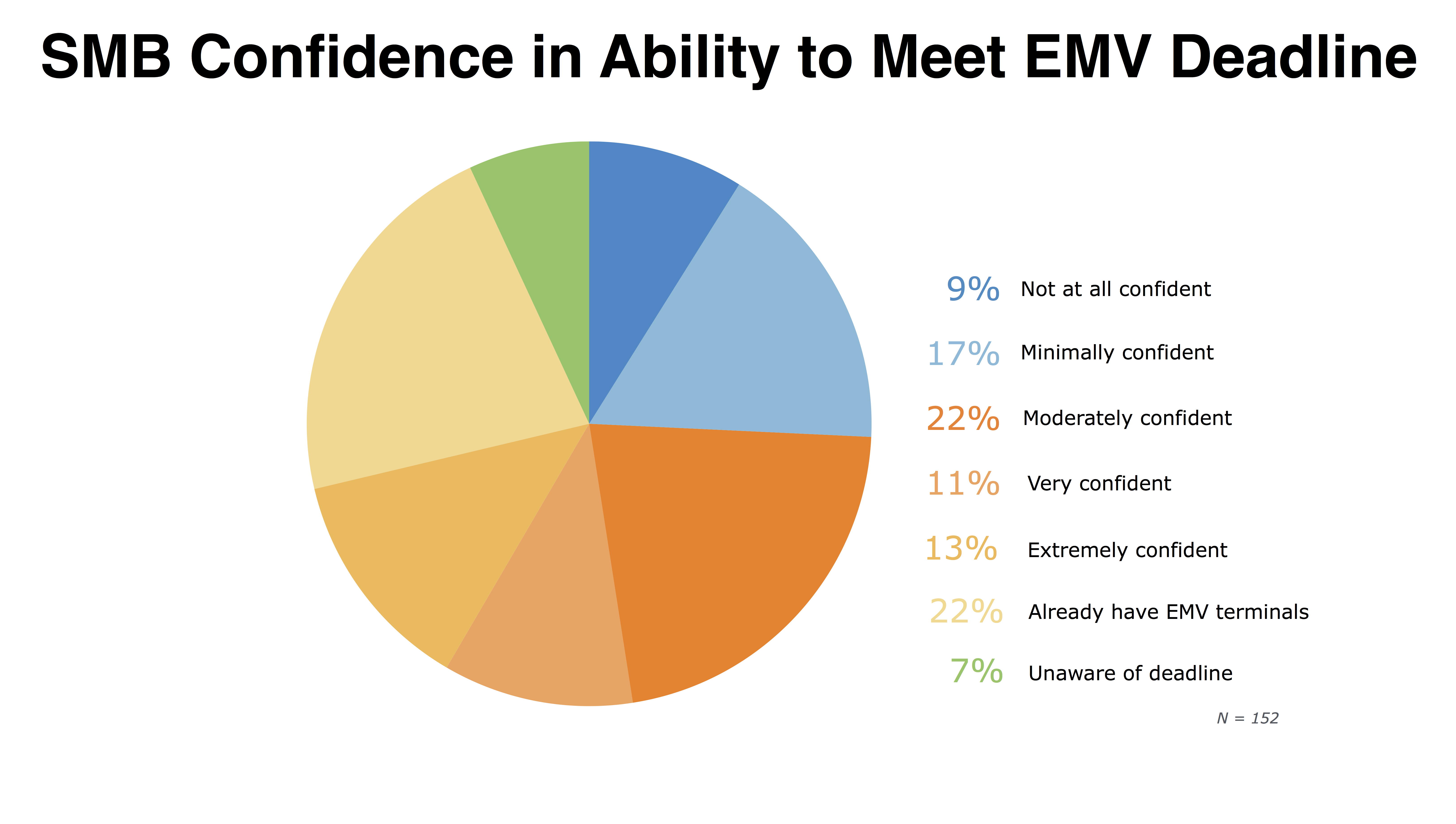

“Our recent report on EMV adoption rates discovered that, with just a few weeks left until the deadline, 78% of SMB retailers aren’t yet EMV chip card compliant. We found that 13% and 11% of retailers are “extremely” or “very” confident they’ll be compliant by the October 1, 2015 deadline. However, the hard fact remains that the deadline is less than a month out and only 22% of SMB retailers are compliant.”

Did that majority of retailers give you any indication as to why they might not be EMV-ready by the Oct. 1st deadline?

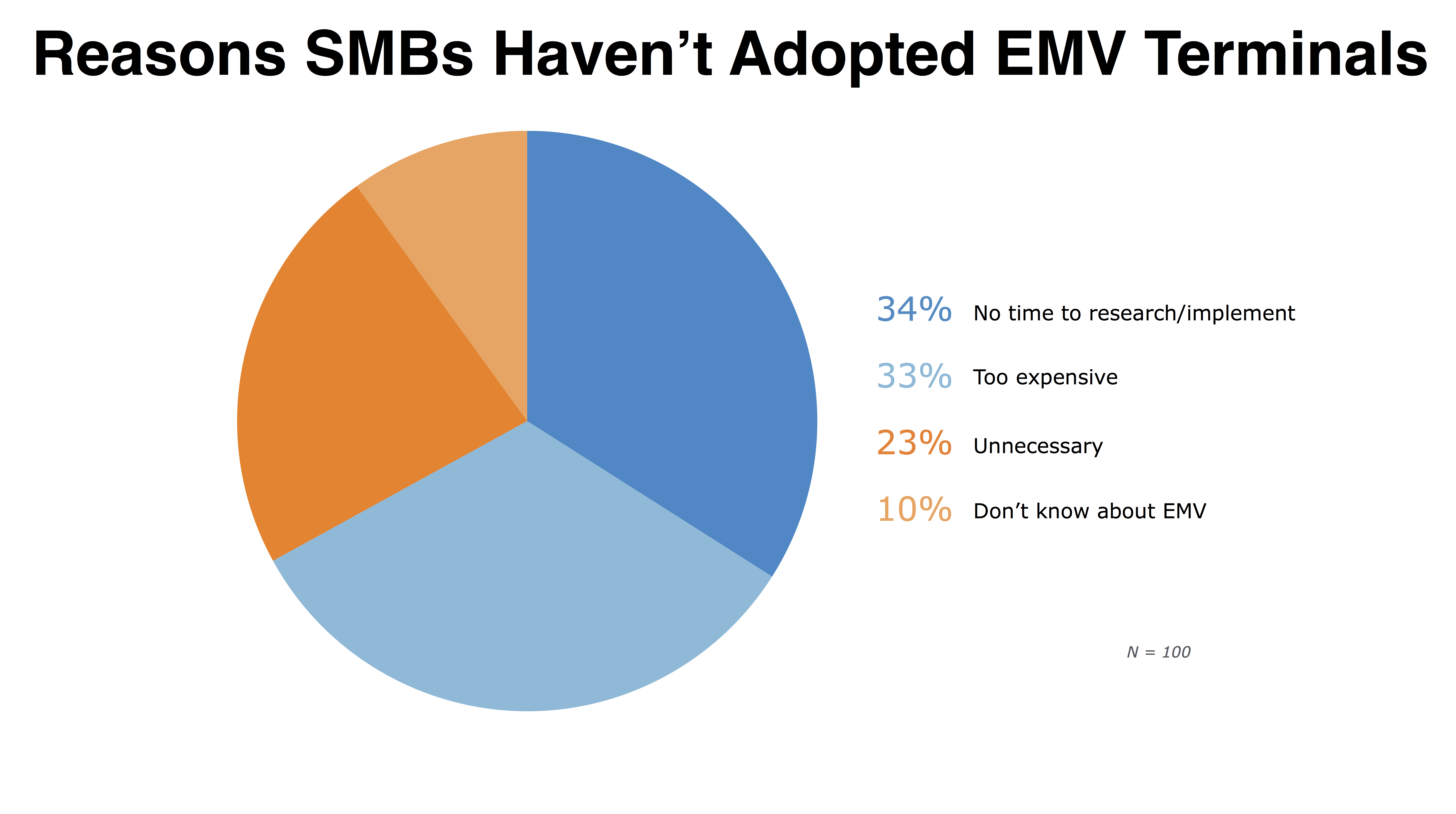

“We surveyed retailers to learn why they’re not EMV-capable. Understandably, 34% of retailers said they don’t have the time to research or implement EMV technologies. Another third (33%) of retailers attribute their non-compliance to the EMV transition being too expensive. These top two reasons for non-compliance are to be expected from retailers who have a lot on their plates everyday. However, the potentially negative impacts from non-compliance can easily outweigh the spend necessary for the transition to EMV liability shift. In fact, with many point of sale providers and credit card processors offering incentives to upgrade, this is the perfect time to make the switch to EMV-capable technology. On top of that, surprisingly, nearly a quarter (23%) of retailers said EMV technology is ‘unnecessary.’ This is a little mind-boggling, given the potentially detrimental and expensive ramifications for non-compliant retailers. The concern with non-compliance is due to the shift in liability for covering fraudulent charges. While it’s traditionally been the card issuers and banks covering fraudulent charges, the liability will now be inherited by the least EMV-compliant party. In other words, once October 2015 hits, the entity (card issuer or retailer) that’s the least secure in its payment processing technology may be liable for fraud if a counterfeit card was used for the transaction.”

Why do you think so many retailers say that EMV is “unnecessary” considering the EMV liability shift?

“It’s very surprising that so many retailers say EMV adoption is unnecessary. Non-compliant SMB retailers will risk negative financial impacts from potential chargebacks resulting from fraudulent charges. Perhaps the reason so many retailers are considering compliance unnecessary is because they don’t understand the liability shift. Over 20% of retailers said their “minimally” or “not at all” confident they understand the liability shift, and shockingly, 14% indicated they “don’t know about the shift”. Clearly retailers are still feeling a bit uninformed about the severity, or even the objectives of the shift.”

You also found that consumers themselves might be unprepared for the deadline. What specifically did you discover?

“On the consumer side of EMV chip card compliance, we found that 62% of US consumers still don’t have EMV cards. Retailers may see this as reason to put their pursuit of EMV compliance on the backburner, but I would suggest against that. Every day retailers spend unprepared is an additional day they risk being victimized by fraudulent card charges.”

If a retailer is a part of that 78% who are not yet EMV-ready, is there something they should do before Oct 1st?

“For those SMB retailers that still haven’t purchased EMV-capable point of sale system, it needs to be one of their top priorities. We understand that 34% of retailers haven’t adopted EMV because they don’t have time to research and implement the technology but this is no excuse. What many retailers do not realize is that the same technology that they are avoiding can free up a significant amount of time by streamlining business operations and enabling them with new payment technologies like Apple Pay, which speed up transaction time. We know from a recent small business report that 64% of retailers still don’t have a POS system in place. These retailers would be wise to use this transition to upgrade to an EMV-compliant POS system that will provide them access to emerging payment technology. Though compliance is an initial priority, it’s just the tip of the iceberg for the many benefits afforded by a proper POS system.”

Want to try ShopKeep for yourself?

Just answer a few easy questions.

Need help finding the right point of sale?

Just complete the form. We’ll call you right back to explain how ShopKeep can work for you.

Hit the ground running.Sprinting, in fact!

Read our free, comprehensive guide, Small Business 101, to learn all you need to know about starting a thriving business.